Gold exchange traded funds etfs are a more convenient and cost effective means of investing in gold stocks especially for those who lack the inclination or time to research specific gold.

Gold etf investment procedure.

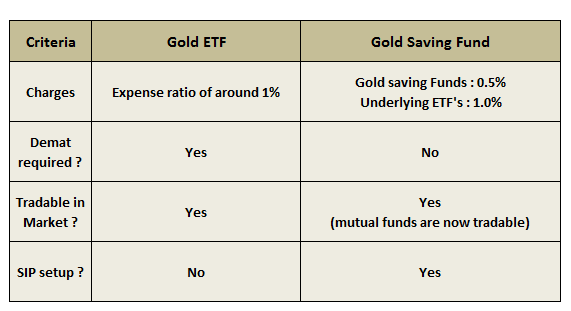

When it comes to investing in gold there are two main ways to do it buy physical gold or invest through an exchange traded fund etf although the etf route comes with an annual expense ratio.

Gold etfs invest 95 99 of their assets in physical gold and the remaining 5 in debt securities and related instruments whereas gold funds invest in stocks of the companies that are engaged in the gold industry.

Thinking about investing in gold.

Hence gold funds provide dividends while gold etfs don t.

Some gold etfs directly track the price of gold while others invest in companies in the gold mining industry.

Three of the largest etfs include spdr gold trust.

As with other types of etfs the issuing company buys stock in gold related companies.

If you don t want the hassle of owning physical gold then a great alternative is to buy an etf that tracks the commodity.

The price of gold increased by 39 2 in the past year significantly exceeding the.

But this etf is the better option today.

The largest gold etf the spdr gold shares etf for example has an expense ratio of 0 40.

0 40 or 40 annually for every 10 000 invested the spdr gold shares gld 178 70 is the first u s traded gold etf and as is the case with.

There are currently 9 etfs focused on tracking the price of gold excluding leveraged or inverse funds.

That means an investor would pay 80 per year in fees for a 20 000 investment.